India’s stock market has experienced a remarkable upward trajectory in recent years, showcasing substantial gains with the S&P BSE Sensex index more than doubling in value since 2010. This dynamic surge is underpinned by a confluence of factors, including the government reforms (PLI scheme, Make in India), robust economic growth, escalating corporate profitability, and an influx of foreign investments.

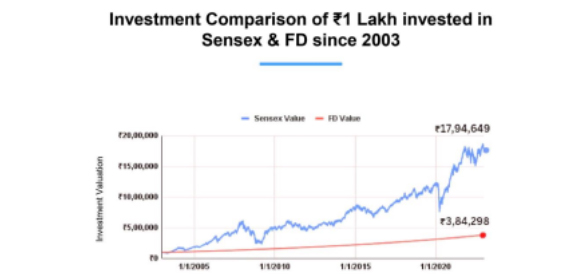

A standout statistic within this narrative is the noteworthy performance of an INR 1 lakh investment in the S&P BSE Sensex in 2010, evolving into INR 2.8 lakhs by FY2022, exhibiting an impressive CAGR of approximately 12%. This signifies that investors who embarked on this journey 12 years ago have reaped substantial returns, showcasing the prowess of a diligent long-term approach.

Several catalysts have fuelled the sustained bull run in India’s stock market. Firstly, the Indian economy has demonstrated robust growth, maintaining an average GDP growth rate of approximately 7% over the past decade, with projections pointing to a continued 6-7% range in the foreseeable future. This healthy economic backdrop has propelled corporate earnings, providing a steadfast pillar for stock market ascendancy.

The allure of India’s growth potential has captivated foreign investors, leading to augmented foreign investments in recent years. In FY2022, foreign investors infused a record INR 4.7 trillion into the Indian stock market, drawn by the nation’s optimistic growth prospects and attractive valuations, which increased the BSE and NSE indices by significantly high margins.

Additionally, the digitization of stock trading has democratized market participation, rendering it more accessible for retail investors. Online trading platforms have simplified the buying and selling process, while governmental initiatives have bolstered transparency and confidence in the market.

The buoyant trajectory of India’s stock market reverberates positively within the nation’s economic fabric. By fostering wealth generation for investors and serving as a financing avenue for businesses, the market fortifies economic vibrancy. Nonetheless, it is prudent to acknowledge the inherent volatility of the stock market and the potential for fluctuation.

It is pivotal to comprehend the impact of market liquidity and global economic dynamics on investment performance. Undoubtedly, the Indian stock market presents an auspicious avenue for long-term wealth creation. While market liquidity remains an evolving aspect, global economic factors possess an intricate interplay with India’s economy, warranting investor vigilance. In this pursuit, meticulous research is paramount. Investors are advised to judiciously align their investment goals and risk appetite(s) before embarking on this journey.